top of page

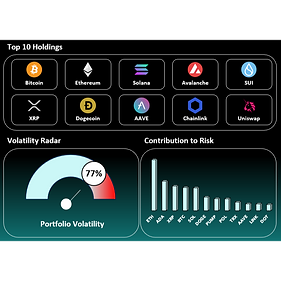

Curated Guidance

Tailored analysis of your existing crypto positions, keeping you in full control of your assets, custody, and counterparty preferences.

Infrastructure Support

Simplify the complexities of managing crypto exchanges, digital wallets, and asset transfers with hands-on support.

Investment Research

Gain monthly access to our actively managed strategies and insights derived from Khelp’s proprietary blockchain KPI framework.

Khelp Select

bottom of page